Complex Order Ticket

Table of Contents

1. Introduction

1.1 Purpose

This document provides an overview of the SILEXX OEMS Complex Order Ticket Module. Therefore, our intent here is to provide you guidance, on both basic and advanced functionalities.

The Complex Order Ticket allows you to place exchange supported multi-leg trades.

In this section we will cover how to:

- Launch the Complex Order Ticket

- Read the Quote Information on the Complex Order Ticket

- Place and Modify orders in the Complex Order Ticket

- Change the Complex Order Ticket Default Settings

2. Launching the Complex Order Ticket

The Complex Order Ticket can be opened from the following places:

- Main Screen

- Option Chain Module

- Order Book

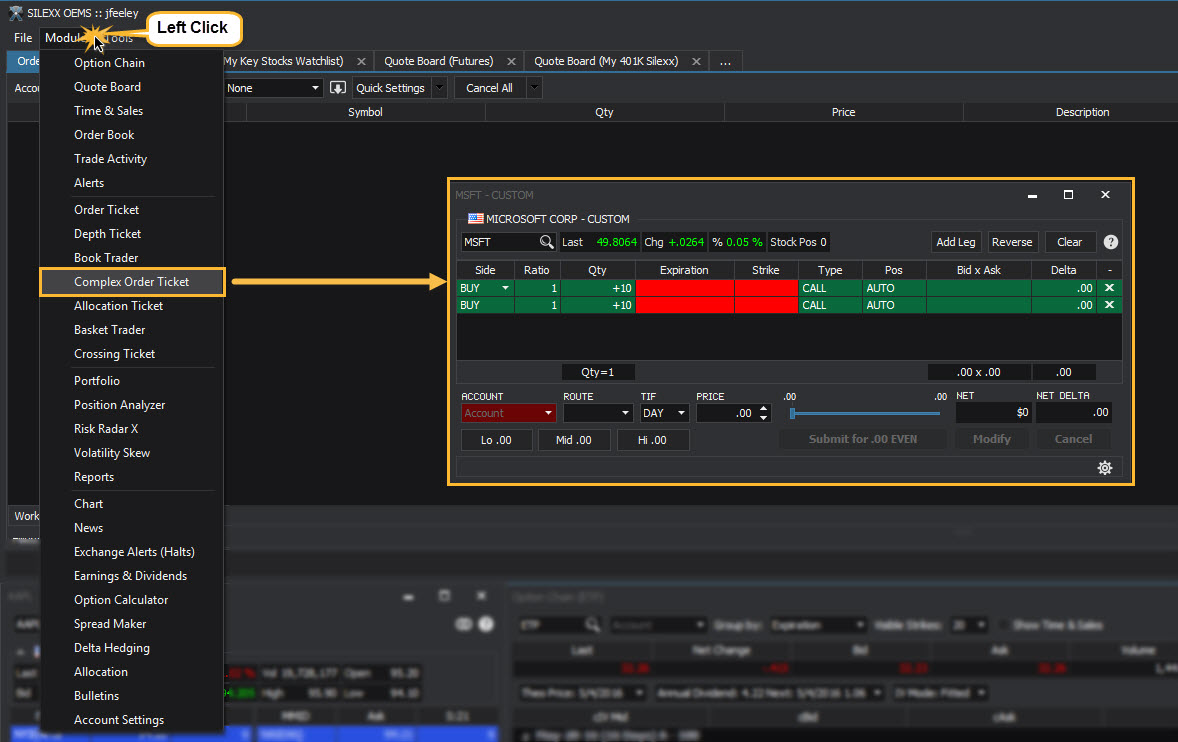

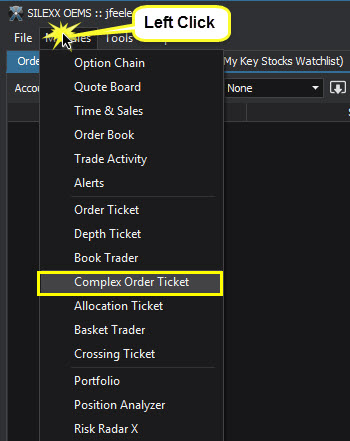

2.1 Launching the Complex Order Ticket from the Main Screen

Launching the Complex Order Ticket from the main screen will open a blank Complex Order Ticket window.

- Click Modules

- Select Complex Order Ticket

Enter the Underlying symbol in the upper left corner field and press enter on your keyboard to activate the Complex Order Ticket.

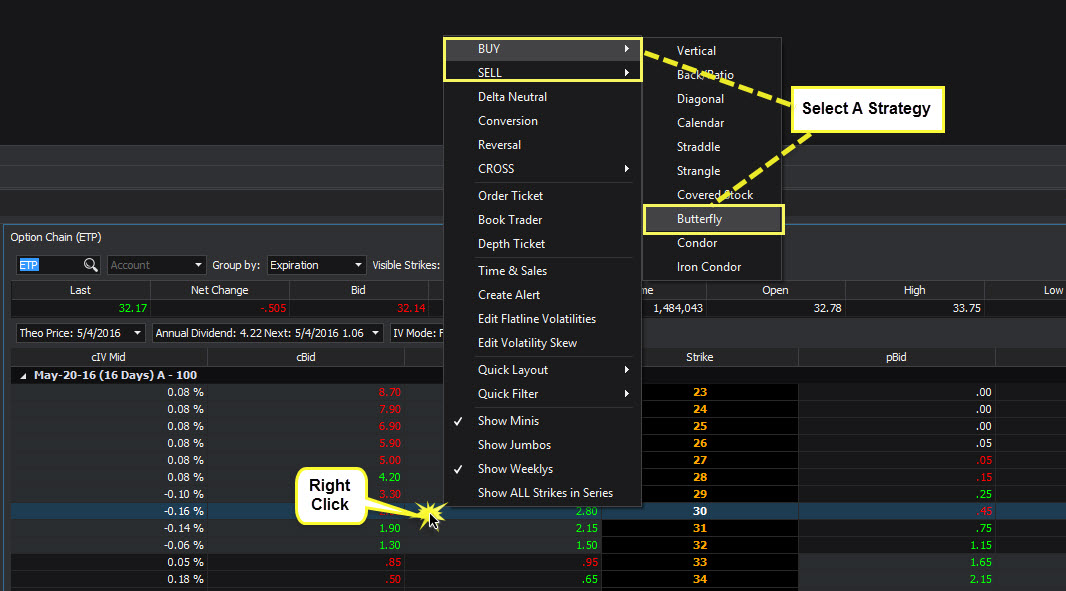

2.2 Launching the Complex Order Ticket from the Option Chain

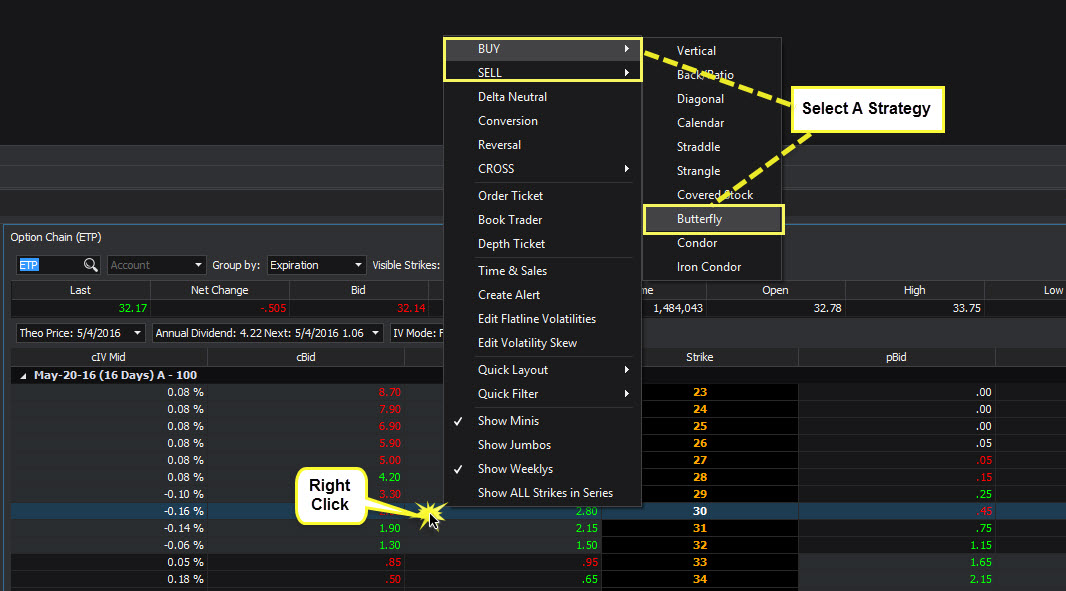

- Right-click a strike row (any column except the Strike column)

- Select Buy or Sell

- Select a strategy from the list

This will open a multi-leg (Complex) Order Ticket populated with options (and/or stock) corresponding to the selected strategy and strike row. The current active account will also be populated in the ticket.

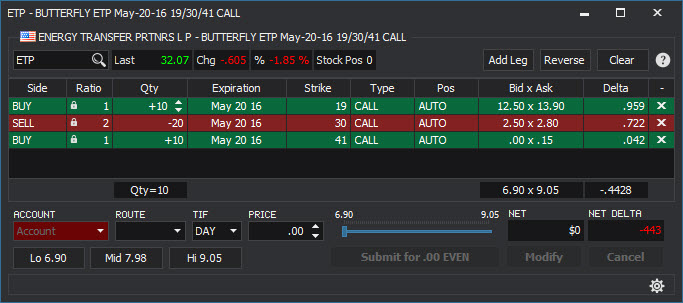

Example: Butterfly

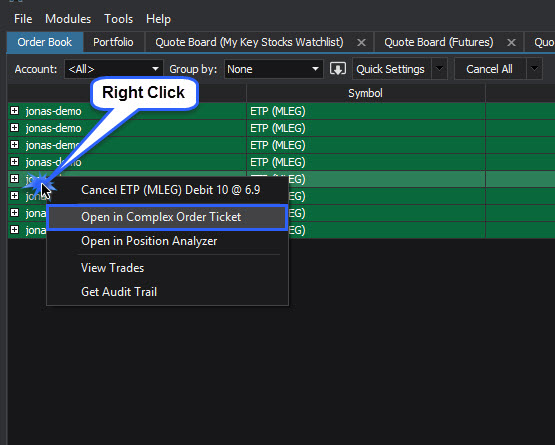

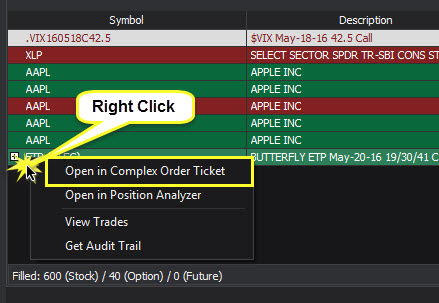

2.3 Launching the Complex Order Ticket from the Order Book

Working and non-working multiple-leg (MLEG) orders can be re-opened in a Complex Order Ticket through the Order Book module.

- Right-click in a row containing a MLEG order

- Select Open in Complex Order Ticket From the Working section:

From the Filled section:

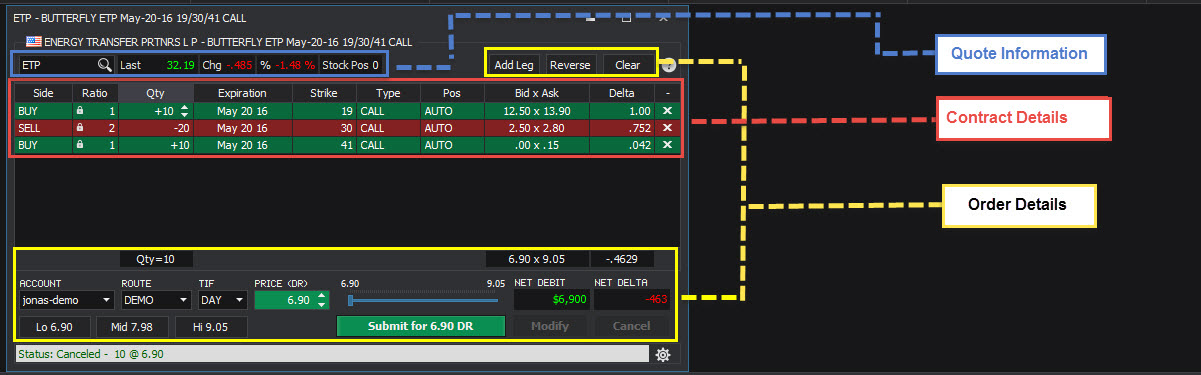

3. Reading the Information on the Complex Order Ticket

Information on the Complex Order Ticket is grouped in the following manner:

- Order Details

- Position Details

- Quote Information

3.1 Order Details

| Field | Description |

|---|---|

| Underlying | Underlying security |

| Account | Account in which the trade will be placed (default account can be changed in the Settings menu) |

| Route | Exchange route for the order |

| TIF | Time-in-Force |

| DAY | Day order - Order will cancel at the end of regular trading hours |

| GTC | Good Till Cancel - The order remains active until canceled |

| IOC | Immediate Or Cancel - Fill the order immediately at the limit price or cancel |

| Net | Enter the price for the complete order DEBIT Place the trade as a debit trade EVEN Place the trade for even money CREDIT Place the trade as a credit trade |

| AON | All-Or-None; Check the box to place the order as an All-or-None order, the order will fill in entirety (no partial fills) or will cancel at the end of the trading day (option orders only) |

3.2 Contract Details

| Field | Description |

|---|---|

| Side | Enter each leg as either a BUY or a SELL |

| Qty | Quantity of shares or contracts to be traded. A default order quantity can be saved in SILEXX OEMS's Settings menu. Manually type or use the arrows to change the quantity value |

| Expiration | Select the expiration month for the underlying's options |

| Strike | Select the strike price for the option (will be blank for stock purchases) |

| Type | Select the type of security for the leg (CALL, PUT, or STOCK) |

| OPEN/CLOSE | Declare each leg as either an opening or closing trade |

3.3 Quote Information

| Field | Description |

|---|---|

| Field | Description |

| (Bid x Ask) | Current market NBBO (National Best Bid and Offer) pricing for each leg |

| Market Price | Marketable price for the multi-leg order (calculated with buying at ASK and selling at BID) |

| Midpoint Price | Midpoint price for the multi-leg order (calculated with buying and selling at bid/ask average) |

Tip - clicking any price quote will populate the Net price field with the clicked value.

4. Placing and Modifying Orders through the Complex Order Ticket

In this section we will cover how to:

- Build a complex order from scratch

- Load pre-defined strategies on the Complex Order Ticket

- Modify an order

4.1 Building a Complex Order from Scratch

- Manual Entry

- Open a blank Complex Order Ticket

- Click Modules on the main screen

- Select Complex Order Ticket

- Open a blank Complex Order Ticket

- Enter an Underlying symbol

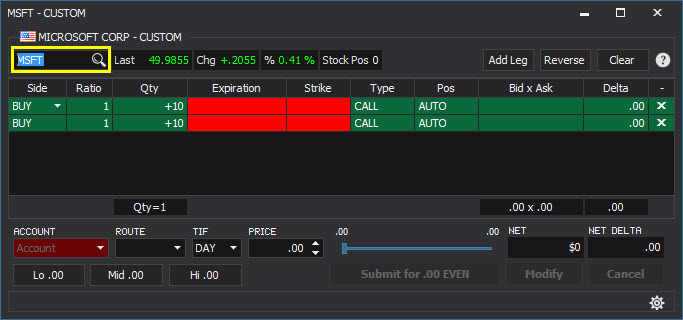

Two legs will become highlighted on the ticket (you may enter up to four legs on a single Complex Order Ticket)

(Please note: not all exchanges support the same combinations of multi-leg orders. Depending on your strategy, some exchanges might reject orders for multi-leg strategies that are not natively supported.)

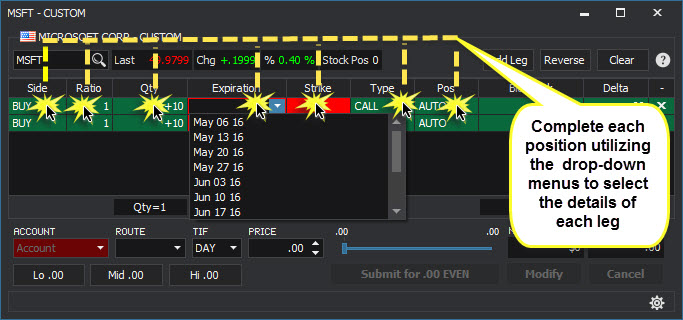

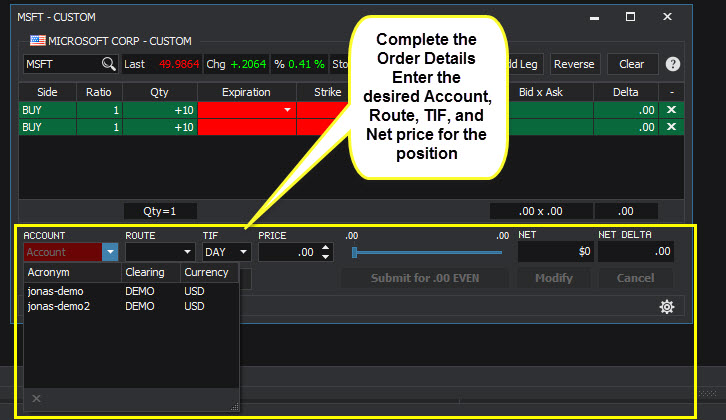

- Complete the position Use the drop-down menus to select the details of each leg

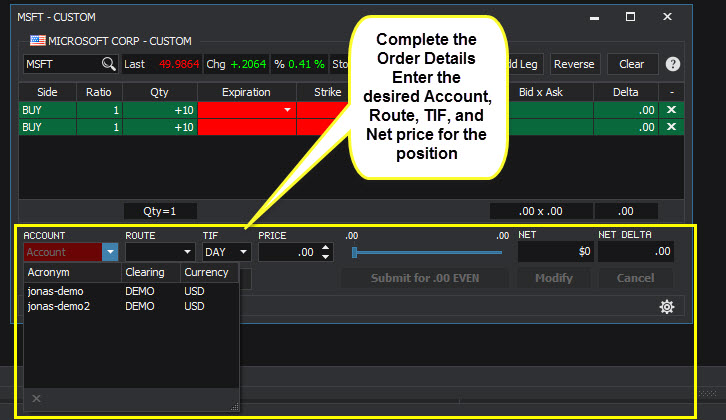

- Complete the Order Details Enter the desired Account, Route, TIF, and Net price for the position.

Tip: Clicking on any price quote will populate the Net field with that price.

- Click the Send Order button to send the order request

-

Drag and Drop from an Option Chain

- Open a blank Complex Order Ticket

- Click Modules on the main screen

- Select Complex Order Ticket

- Open a blank Complex Order Ticket

-

Enter an Underlying symbol

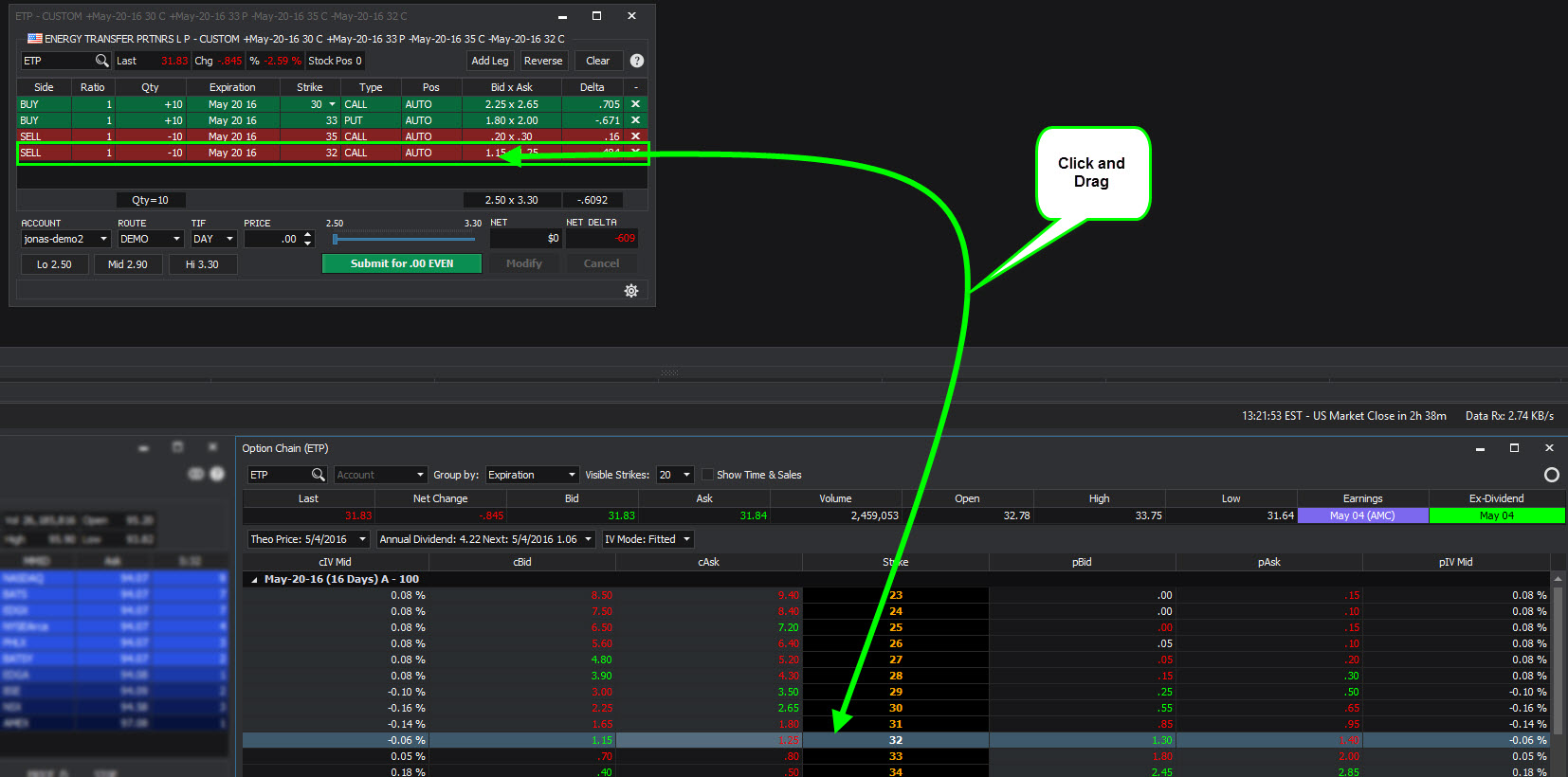

- Left-click and drag from the option screen to a leg row on the Complex Order Ticket

-

Drag from the Bid column to set the leg as a Buy

-

Drag from the Ask column to set the leg as a Sell

- Repeat for up to twelve legs

(Note: Dragging an option over a populated row will overwrite the data in the row.)

- Complete the order details Enter the desired Account, Route, TIF, and Net price for the position.

Tip: Clicking on any price quote will populate the Net field with that price.

- Click the Send Order button to send the order request

4.2 Loading Pre-defined Strategies in the Complex Order Ticket

- Right-click in any column except the Strike column

- Select BUY or SELL

- Select a strategy with which to populate the Complex Order Ticket

4.2.1

| Field | Description |

|---|---|

| Buy | Populate the Complex Order Ticket to the Buy side for the strategy |

| Sell | Populate the Complex Order Ticket to the Sell side for the strategy |

4.2.2

The following descriptions are to the Buy side (positions are reversed to the Sell side):

| Field | Description |

|---|---|

| Vertical | Buy the selected Strike, Sell the next higher price Strike, same Expiration and Type |

| Back/Ratio | Sell the selected Strike and Buy the next higher Strike with QTY = two times (2x) the Sell leg |

| Diagonal | Buy the selected Strike, Sell the next lower price Strike, same Expiration and Type |

| Calendar | Buy the selected Strike, Sell the next month option, same Strike and Type |

| Straddle | Buy a Call and Put with same Strike and Expiration |

| Strangle | Buy a Call and Put with same Expiration, different Strike |

| Covered Stock | Buy the underlying and sell the near month Call option of the selected strike |

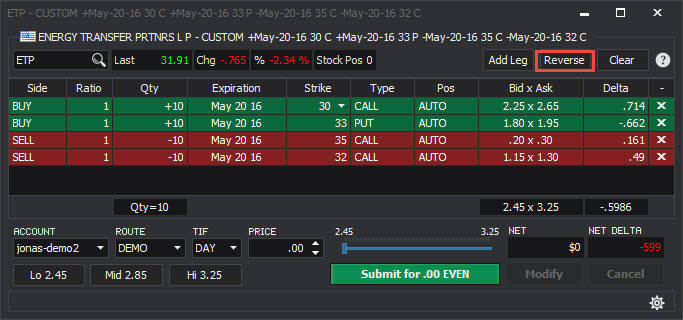

| Butterfly | Sell two times (2x) the selected strike, Buy one (1) each of the next higher and next lower Strikes. Three-leg position in the ratio of Buy (1): Sell (2): Buy (1) (bold is selected Strike) |

4.2.3

| Field | Description |

|---|---|

| Condor | Sell the selected Strike; Sell the next higher Strike; Buy the next lower Strike; Buy two Strikes upto Four-leg position in the ratio of Buy (1): Sell (1): Sell (1): Buy (1) (bold is selected Strike) |

4.2.4

| Field | Description |

|---|---|

| Iron Condor | Call-side: Buy a Call Vertical and Buy a Put Diagonal. Put-side: Buy a Put Vertical and Sell a Call Diagonal |

Four-legged position in the ratio of Sell (1): Buy (1): Buy (1): Sell (1) (bold is selected Strike)

4.3 Modify an Order in the Complex Order Ticket

Use the drop-down menus and arrow buttons to modify any data on the Complex Order Ticket

Reverse Button Reverse the Side field on each of the trade legs Buy becomes Sell Sell becomes Buy

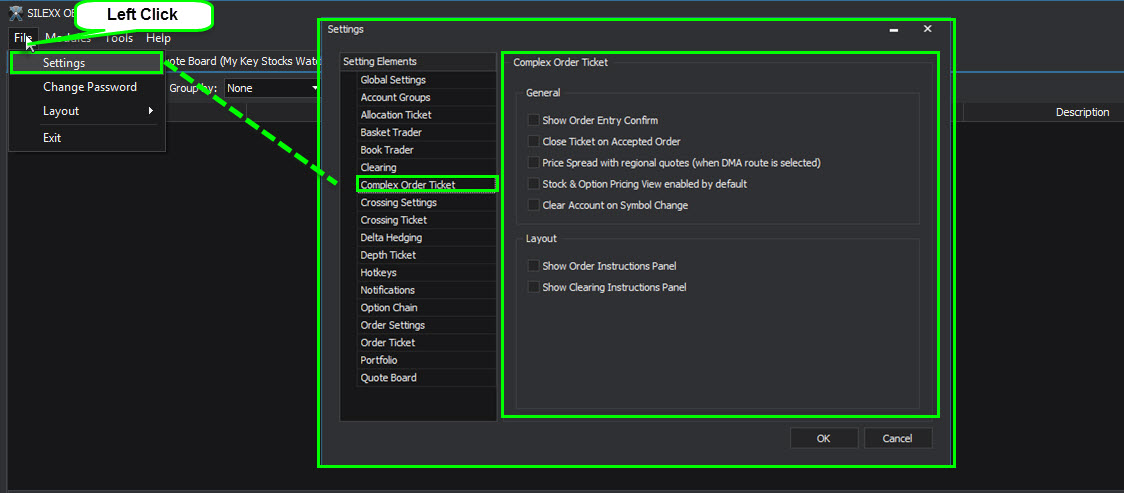

4.4 Changing the Default Complex Order Ticket Settings

- Click File on the main SILEXX OEMS screen

- Select Settings

- Select Complex Order Ticket in the "Setting Elements" section