Risk Radar X

Table of Contents

1. Introduction

1.1 Purpose

This document provides an overview of the SILEXX OEMS Risk Radar X Module. Therefore, our intent here is to provide you guidance, on both basic and advanced functionalities.

In this manual we will cover how to:

- Access Risk Radar X

- Read the information on the Risk Radar X module

- Manipulate and customize the display

- Group accounts

- Customize the spreadsheet data

- Freeze columns

- Filter and sort

- Graphically analyze positions

2. Accessing Risk Radar X

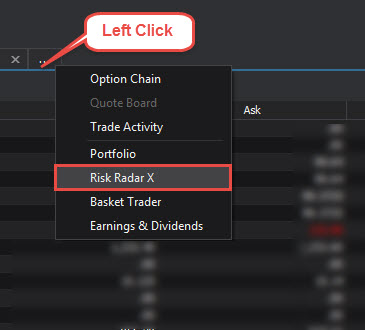

- Opening Risk Radar X as a new window: Click Modules and select Risk Radar X

- Opening Risk Radar X as a tab on the Main screen: Click the "..." tab on the main screen and select Risk Radar X

3. Reading Information on Risk Radar X

Main Header Bar Controls

| Field | Description |

|---|---|

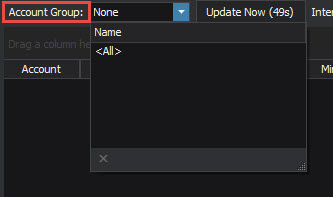

| Account Group: | Selects an account group as set-up in the main settings menu Note: Risk Radar X defaults to interval updating to minimize bandwidth usage |

| Update Now (##s) | Click to manually update the spreadsheet with current market data (if not in live mode) |

| Interval: | Sets the automatic update interval (in seconds) |

| Real-time Mode | Check the box to turn on real-time updating Note: Large portfolios will require a great deal of bandwidth while in live mode |

| Date: | Changing the date field to a future date extrapolates your account/position's risk values for that selected date. |

| Step %: | Sets the interval between the theoretical risk columns ("#.## %" columns) |

| IVol: | Switches between applied volatility models |

| Fitted: | Polynomial Interpolation/Extrapolation (Tail-Capped Binomial Model) |

| ATM: | Weighted At-the-Money Volatilities |

| Option Implied: | Per-Option Implied Volatilities |

| IV +- : | Manually adjust the volatility applied to risk calculations. The value entered will increase/decrease all current option volatility values in the module by the amount (points) entered. |

4. Customizing the Data Display

4.1 Grouping accounts

View your aggregate risk/P&L at many different levels including:

Account level: You can display your custom Account Groups on the Risk Radar X using the Account Group pull-down menu.

Note: Account Groups are created in the System Settings menu.

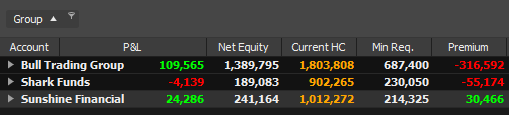

Trading group level: Drag and drop grouping Left-click and drag a column header to the section labeled "Drag a column here to group by that column" to create a sub-grouping based on that column.

Example: You can associate group names with account numbers using the "Group" column text fields and view accounts associated by the assigned text.

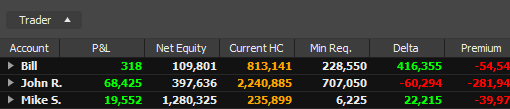

Trader grouping: Example: You can associate individual trader names with account numbers using the "Trader" column text fields and view accounts associated by the assigned trader.

5. Column Customization

The data displayed on the Risk Radar X spreadsheet can be customized by adding / removing, resizing, and re-ordering columns.

Click here for the complete guide to Column Customization

5.1 Account Level Data Definitions

| Field | Description |

|---|---|

| $ Delta | Delta Value * Mark |

| BP Used | Theoretical dollar risk based on percentage move of the underlying security. Can be user defined. |

| Account | Account number |

| Alias | User defined text field. Allows you to assign an Alias to an account for reference purposes. |

| BP | Buying Power |

| Calls Bought | Gross number of Call contracts purchased |

| Calls Sold | Gross number of Call contracts sold |

| Comment | User defined text field. Allows you to type comments for reference. |

| Contact | Contact information |

| Crash | Theoretical risk based on a 25% market decrease and a 50% volatility increase |

| Current HC | Current Haircut margin requirement |

| Delta | Net Delta for the account |

| Drops # | Number of order dropped into SILEXX OEMS |

| Equity | Account equity. Broker supplied value |

| Fut Bought | Gross number of Futures contracts purchased |

| Fut Sold | Gross number of Futures contracts sold |

| Fut Traded | Gross number of Futures contracts traded |

| Fut Working | Gross number of Futures contracts on working orders |

| Gamma | Net Gamma for the account |

| Gross Exp | Gross Exposure |

| Gross Exp L | Gross Exposure Long - Gross long exposure |

| Gross Exp S | Gross Exposure Short - Gross short exposure |

| Group | User defined text field. See this section for further details |

| Linear Decay | {Premium / Days left to expiration} |

| Lvrg. Ratio | Leverage Ratio - {Gross Exposure / Net Equity} |

| Market Value | Net market value of the open positions |

| Min Req. | Minimum Required haircut margin. [$25 per contract] |

| Net Calls # | Net number of Call contracts in the account |

| Net Equity | Net account equity. {Equity + P&L} |

| Net Puts # | Net number of Put contracts in the account |

| Net Stock # | Net number of Stock shares in the account |

| Opt Traded | Gross number of Option contracts traded |

| Opt Working | Gross number of Option contracts on working orders |

| Orders # | Total number of orders sent through SILEXX OEMS on the day |

| P&L | Profit / Loss calculation [marked to market] |

| P&L Theo | Profit / Loss Theoretical - Theoretical P&L based on theoretical option prices |

| Performance | Account performance - {P&L / Equity} |

| Platform | Trading platform of origin (if other than SILEXX OEMS) |

| Premium | Net option premium |

| Puts Bought | Gross number of Put contracts purchased |

| Puts Sold | Gross number of Put contracts sold |

| Qty | Displays the net quantity of shares/contracts in the account. U: = underlying, C: = Calls, P: = Puts |

| Realized P&L | Net Profit / Loss realized on the day from closing positions |

| Rho | Net Rho for the account |

| Stk Bought | Gross number of Stock shares purchased |

| Stk Sold | Gross number of Stock shares sold |

| Stk Traded | Gross number of Stock shares traded |

| Stk Working | Gross number of Stock shares on working orders |

| Takeover | Theoretical risk based on a 25% market increase and a 50% volatility decrease |

| Thet | Net Theta for the account |

| Trader | User defined text field. See this section for further details |

| Type | Account type classification |

| Unrealized P&L | Net Profit / Loss on the day on positions that are currently active in the account |

| Vega | Net Vega for the account |

| Volatility | Theoretical risk based on a 50% volatility increase |

5.2 Symbol Level Data Definitions

| Field | Description |

|---|---|

| $ Delta | Delta Value * Mark |

| % Change | Percent change of the underlying security |

| BP Used | Theoretical dollar risk based on percentage move of the underlying security. Can be user defined using the Step control field in the main header bar. |

| Avg. Volume | Average volume for the underlying security |

| Bid x Ask | Underlying bid and Ask quotes |

| Calls Bought | Gross number of Call contracts purchased |

| Calls Sold | Gross number of Call contracts sold |

| Calls Traded | Gross number of Call contracts traded |

| Change | Change in price on the day for the underlying security |

| Crash | Theoretical risk based on a 25% market decrease and a 50% volatility increase |

| Current HC | Current Haircut margin requirement |

| CUSIP | 9-character alphanumeric code for the purposes of facilitating clearing and settlement of trades |

| Delta | Net Delta |

| Description | Full description of the underlying security |

| Div. Annual | Annual Dividend |

| Div. Yield | Dividend yield percentage |

| Earnings | Next earnings date (if available) |

| Ex-Dividend | Ex-dividend date (if available) |

| Fut Bought | Gross number of Futures contracts purchased |

| Fut Sold | Gross number of Futures contracts sold |

| Fut Traded | Gross number of Futures contracts traded |

| Fut Working | Gross number of Futures contracts on working orders |

| Gamma | Net Gamma |

| Gross Exp | Gross Exposure |

| Gross Exp L | Gross Exposure Long |

| Gross Exp S | Gross Exposure Short |

| Industry | Industry classification for the underlying |

| Last | Last trade price |

| Linear Decay | {Premium / Days left to expiration} |

| Market Cap. | Market capitalization of the underlying |

| Min. Req | Minimum Required haircut margin |

| Net Calls # | Net number of Call contracts in the selected account(s) in the underlying |

| Net Puts # | Net number of Put contracts in the selected account(s) in the underlying |

| Net Stock # | Net number of Stock shares in the selected account(s) in the underlying |

| Opt Traded | Gross number of Option contracts traded |

| Opt Working | Gross number of Option contracts on working orders |

| P&L Profit | Profit / Loss for the position(s) held in the selected account(s) |

| P&L Theo | Profit / Loss Theoretical - Theoretical P&L based on theoretical option prices |

| Premium | Net option premium |

| Prev Close | Underlying Previous Close price |

| Puts Bought | Gross number of Put contracts purchased |

| Puts Sold | Gross number of Put contracts sold |

| Puts Traded | Gross number of Put contracts traded |

| Qty Net | Quantity summary |

| Rho | Net Rho |

| Sector | Sector in which the underlying is listed |

| Stk Bought | Gross number of Stock shares purchased |

| Stk Sold | Gross number of Stock shares sold |

| Stk Traded | Gross number of Stock shares traded |

| Stk Working | Gross number of Stock shares on working orders |

| Symbol | Underlying Symbol |

| Takeover | Theoretical risk based on a 25% market increase and a 50% volatility decrease |

| Vega | Net Vega |

| Volatility | Theoretical risk based on a 50% volatility increase |

5.3 Position Level Data Definitions

| Field | Description |

|---|---|

| % Change | Percent change of the underlying security |

| Account | Account number |

| Bid x Ask | Underlying bid and Ask quotes |

| Change | Change in price on the day for the underlying security |

| Delta | Position Delta |

| Description | Full description of the underlying security |

| Last | Last trade price |

| Mark | Midpoint of the Bid / Ask price |

| P&L | Profit / Loss for the position |

| Prev Close | Previous Close price |

| Price Avg. | Price Average - {(OpeningQty OpeningCost + TradingNetQty TradingFIFOCost) / (OpeningQty + TradingNetQty)} |

| Qty | Quantity |

| Symbol | Security's Symbol |

| Theo | Theoretical price |

5.4 Freezing Columns

Columns can have fixed either to the left or right side so that they will always be in view when scrolling horizontally.

5.5 Saving Custom Layouts

Right-click anywhere in the spreadsheet and select Quick Layout

Select Save Current Layout As...

Enter a name for the layout and select Save

The named layout is now available in the Quick Layout menu

5.6 Filters and Sorting

Data on the spreadsheet can be quickly organized using SILEXX OEMS's filtering and sorting functions.

Click here for the complete guide to Filters and Sorting

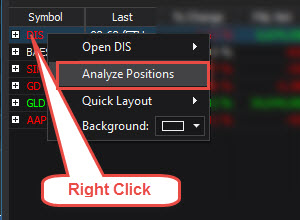

5.7 Viewing a Position with Position Analyzer

In the Underlying section of Risk Radar X, right-click the row of the security for which you want to analyze graphically.

A Position Analyzer widow will launch with all positions in the selected underlying active on the analyzer.